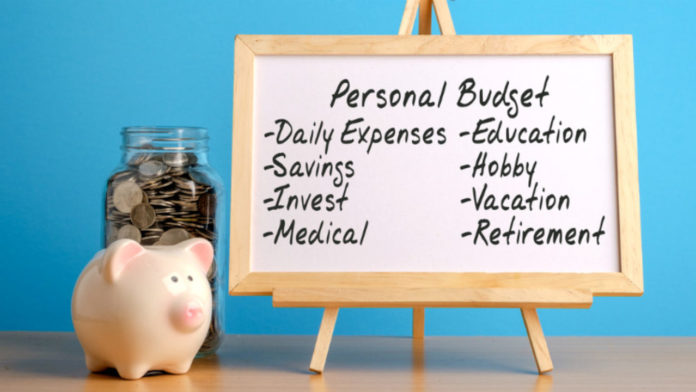

Does the word budget haunt you? Well, maybe because of the bad rap it has gotten. However, budgeting simply means to spend your income with purpose.

Many people consider it something that prevents them from doing what they want to, though. But that’s not the truth. Budget is something that gives you freedom rather than limiting your freedom. It is all about being aware of where your money is going.

Read Also: 8 Simple Ways To Prevent Yourself From Stroke

So, if you are someone who has always dreaded budgeting for one reason or the other, it is time for you to know that budget gives you a clear picture of where you are ending up spending your money. It will help you achieve your financial goals.

10 Budgeting Tips to Get Your Financial Life on Track

So, are you ready to live a budgeted life? Here are some tips to follow!

1. Choose a Zero Based Budgeting

This means making a financial action plan and naming every dollar you earn before even the month starts. This is called zero-based budgeting, which is more time-consuming than the traditional approach of budgeting. It requires you to start from scratch and devise a strategy to identify where the expenses can be cut.

Read more Best Budgeting Tips on Sow Your Money

2. Have a Family Budgeting Day

If you are married, it is good to sit and do budgeting together. Have a fun family budgeting day. It is good to get you and your partner on the same page. Set your goals together and craft a practical financial plan.

If you are single, ask a friend or a loved one to help you stick to your goals.

3. Every Month is Different

Some months you will be saved for birthdays or Christmas or vacation. Other months you will have to budget for things like routine car maintenance or school supplies. Irrespective of the situation, ensure you put in those expenses in the budget, and adjust your budget every month.

5. Pay off Your Debt

Paying the debt off has to be a top priority if you have one. The debt snowball method recommended by many finance authors and experts is something that can make a huge difference in your budget.

6. Embrace the Budget Cuts

It might be time to trim your budget, don’t be afraid! If the budget is tight right now, you can save money instantly by dining out less, cutting out on junk food, canceling your cable, availing the sales and discount offers. Just remember these cuts are permanent. It is just a phase, which will pass.

7. Track Your Progress

Checking your progress from time to time in important when you have a budget to follow. Track your purchases and spending to keep your goals in sight. Also, have a look at your earlier budgets to see how far you have come and what you have achieved so far. And, celebrate the small achievements

8. Keep the Unexpected Expenses in Mind

While crafting a budget, do not forget to make a category of miscellaneous. This category includes putting a small amount aside for the unexpected expenses. This will help you cover the unexpected emergencies without taking away from your saved money. But, remember to keep track of money that frequently winds up in this category. Who knows, you might even end up promoting these expenses to a permanent spot on the budget roster.

9. Ditch the Credit Cards

Are you really committed to getting out of debt and sticking to your budget? Well, those credit cards are what you need to ditch – for good! Cut them up! Like, seriously! That is a good way to help you stop using them. Simply, get them out of your financial life, if you really want to control your extra expenses and have a robust financial plan.

10. Try an Online Budget Tool

If spreadsheets or paper and pen are not your things and you want to try something smarter, try online budgeting tools. There are a variety of budgeting tools available on the internet today. So, join the digital world and focus on crafting your smart budget and track your expenses from the comfort of your smartphone! Also, you can easily sync up your budget with your partner with the help of this tool. Sounds great? I know! The budgeting tool is great for keeping that communication open.

Final Thoughts

Budgeting tips allows a person to create a spending action plan for their hard-earned money. It ascertains that you will always have enough funds with you for the things that are important to purchase. Plus, it helps you be prepared in advance for the birthdays of your loved ones. Moreover, following a plan will also keep you out of debt, or if you are currently in debt, it will help you work your way out of this nuisance. Realizing that the aim of budgeting is to give you freedom, rather than limiting the freedom, will give you a chance to walk on a road to loving your life as well as your bank balance! And, the basic budgeting tips mentioned above are sure to help you with crafting a robust budget to make your financial life easier. See the best survey sites for earning money that can help you manage your budget easily.